10-17-2011, 10:04 PM

10-17-2011, 10:04 PM

|

#17 (permalink)

|

|

Master EcoModder

Join Date: Jul 2009

Location: New York

Posts: 513

Thanks: 2

Thanked 101 Times in 74 Posts

|

choice B none of the above

so far this thread is nothing but smoke and mirrors , the comments linked above are designed to distract the viewers from what is real.

imho.

consider this ;

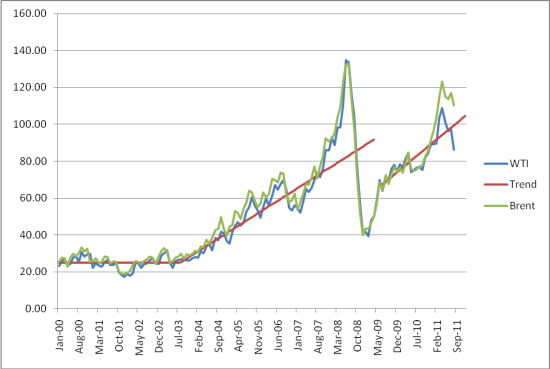

your graph does not really show an increase in the price of oil

what it really shows is a

decrease in the value and purchasing power of the dollar

this decrease in value of the dollar is not a "normal" fluctuation in the "market" . and in fact has nothing at all to do with supply and demand of oil .

or anything else , it does not in fact follow an economic model at all .

because the alleged "economic market" fluctuations are skillfully controlled ...

if you wish to learn more, a KISS version, watch what is below

http://www.youtube.com/user/theamericandreamfilm

and if you really want to learn about the subject - watch what is below

Quote:

Originally Posted by suspectnumber961

Peak oil has arrived......??

The Oil Drum | A Brief Economic Explanation of Peak Oil

"For a number of years there has been an arid debate between economists and geologists about Peak Oil. The geologists maintain that Peak Oil (maximal production) is a geological imperative imposed because reserves are finite even if their exact magnitude is not, and cannot be, known.

In contrast many economists maintain prices will resolve any sustained supply shortfalls by providing incentives to develop more expensive sources or substitutes. The more sanguine economists do concede that the adaptation may be slow, uncomfortable and economically disruptive.

The reality, I believe, is that both groups have part of the answer but that Peak Oil is, in fact, a complex but largely an economically driven phenomenon that is caused because the point is reached when: The cost of incremental supply exceeds the price economies can pay without destroying growth at a given point in time. While hard to definitively prove, there is considerable circumstantial evidence that there is an oil price economies cannot afford without severe negative impacts.

The corollary is that if oil prices fall back to and sustain levels that do not inhibit growth, then economic growth will resume, with both recoveries and downturns lagging oil price changes by 1-6 months."

Oil prices and recessions...a NEW recession underway now.....who knew?

Well you know now....

"The conclusion appears to be that:

"The conclusion appears to be that:

Unless and until adaptive responses are large and fast enough to constrain the upward trend of oil prices, the primary adaptive response will be periodic economic crashes of a magnitude that depresses oil consumption and oil prices. These have the effect of shifting consumption from incumbent consumers—the advanced economies—to the new consumers in the developing economies.

This is exactly what happened in the last recession when between the start of the recession in January 2007 and its effective end in 1Q 2011 demand rose by 4.3 million b/d in the non-OECD area and fell by 4 million b/d in the OECD area."

|

Last edited by mwebb; 10-17-2011 at 10:47 PM..

Reason: KISS

|

|

|

|