So, OPEC (mostly S.A.) says they're cutting production at the start of next month. A dozen non-OPEC countries have agreed to do the same (however Canada & the U.S. are absent).

All with the intent of bringing supply in line with demand to stabilize prices. (U.S. oil current stockpiles are at a new record.)

Surprise (!) result: U.S. oil shoots above $50 a barrel.

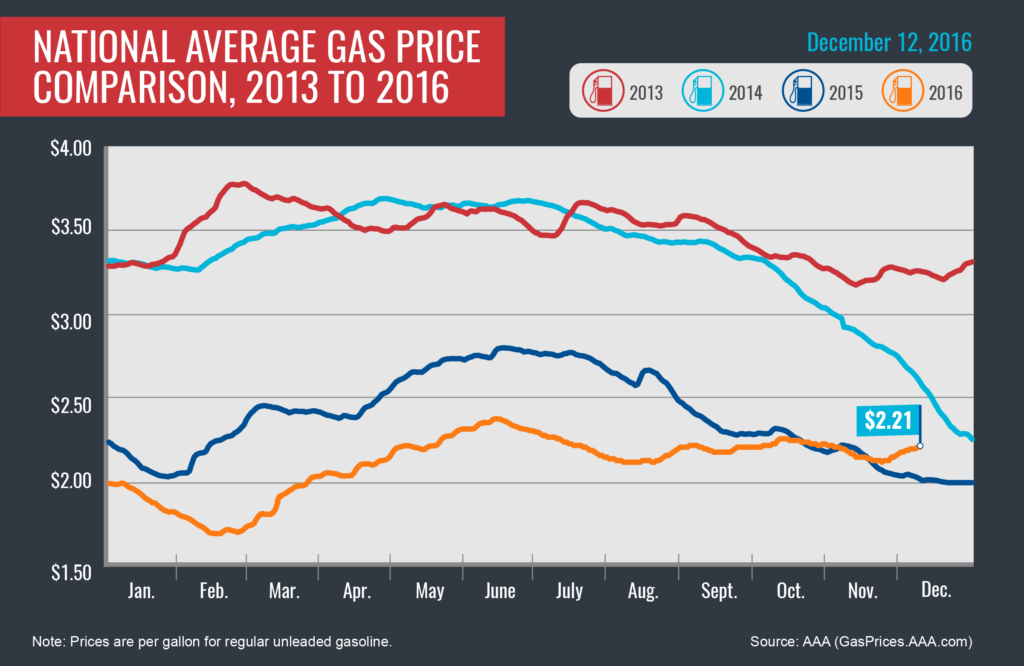

US gas prices have gone up about 5% since then. This year's gas price graph does not look at all like the typical pattern of a slide from the summer peak down to late winter:

Source:

AAA Gas Prices

But will OPEC actually meet its self-imposed cut targets? I'm betting... nope! And if it does, will U.S. and Canadian "expensive" oil production take up the production slack anyway? I'm betting... yup!