Real estate prices are usually sticky, meaning they tend to level off rather than go down in price.

That said, housing prices should follow inflation very closely, and any time it rises much above inflation, it's a bubble.

Either inflation will match the rise in housing costs and therefore it's not a housing bubble, or housing prices will decrease in response to the bubble. The coming recession should increase housing inventory as people consolidate to reduce their expenses.

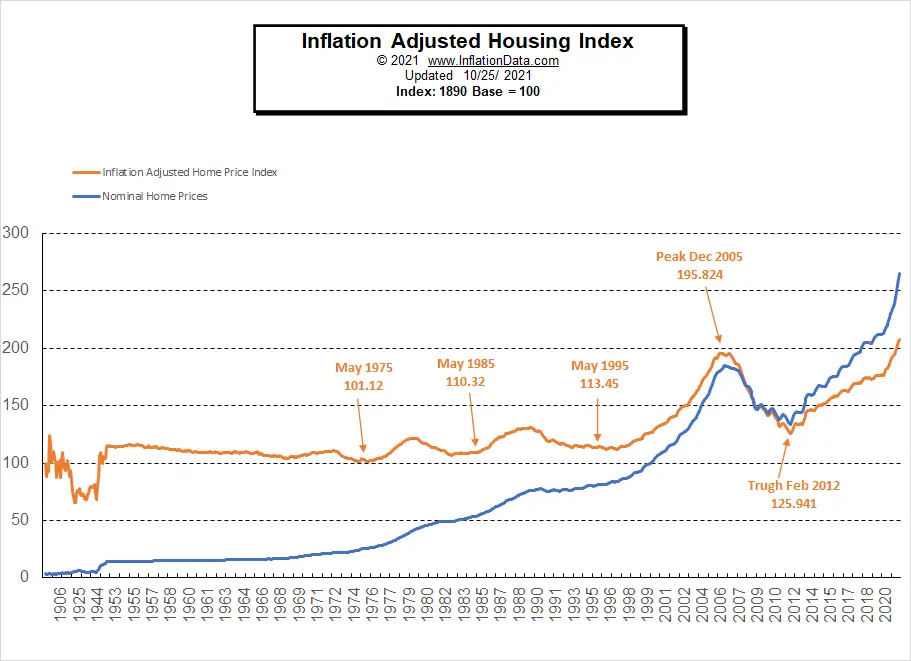

This chart shows house prices really only had a significant drop once in the last 60 years, when the housing bubble burst. We see another bubble forming, but it's hard to say if that's a bubble or inflation.

This chart shows home cost adjusted for inflation (orange line). It should remain relatively flat, but as you see from 2012 on it's been headed up, and much more so in the past couple years. It seems to indicate a bubble of similar size as the previous one.

My take; Wages will catch up to inflation, but there's lag in that process. Meanwhile house prices will decrease, but only slightly. As interest rates rise, house prices must fall in response.

While impossible to predict, it's better to purchase a house when prices are low rather than when interest rates are low. You can always refinance the interest rate when it goes lower, but you cannot refinance the principal cost of the house.