05-02-2022, 02:01 AM

05-02-2022, 02:01 AM

|

#31 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,981

Thanks: 4,370

Thanked 4,530 Times in 3,482 Posts

|

Quote:

Originally Posted by Isaac Zachary

the last time I applied for 100 jobs in a city I got rejected at all but the single absolute worst of them, making nearly half minimum wage at night living in a shared basement.

|

You're clearly a smart individual; so earning potential should be there. I don't have an opinion of what's been working against you, but I don't believe in "bad luck" unless it's just a handful of experiences.

|

|

|

|

Today Today

|

|

|

|

Other popular topics in this forum...

Other popular topics in this forum...

|

|

|

|

05-02-2022, 09:25 AM

05-02-2022, 09:25 AM

|

#32 (permalink)

|

|

High Altitude Hybrid

Join Date: Dec 2020

Location: Gunnison, CO

Posts: 2,121

Thanks: 1,154

Thanked 598 Times in 475 Posts

|

Quote:

Originally Posted by redpoint5

You're clearly a smart individual; so earning potential should be there. I don't have an opinion of what's been working against you, but I don't believe in "bad luck" unless it's just a handful of experiences.

|

I don't think things are going bad for me where I'm at. I would like to purchase a house and can't but that doesn't mean I don't have a good job, an ok place to live and a good life in general.

To me moving to some big city comes with a lot of unknowns, and what I do know I don't like. I just wish housing prices would go back to what they were before COVID. I finally had enough for a 20% downpayment and enough income on a house in my area but then prices tripled and quadrupled. Wages are slowly going up, but I figure I'd need to make at least $65 an hour to afford a house at current prices here.

__________________

|

|

|

|

05-02-2022, 12:22 PM

05-02-2022, 12:22 PM

|

#33 (permalink)

|

|

Somewhat crazed

Join Date: Sep 2013

Location: 1826 miles WSW of Normal

Posts: 4,540

Thanks: 582

Thanked 1,239 Times in 1,094 Posts

|

On the bright side: the Fed is mucking about attempting a "SOFT landing" so expect some sort of recession, and housing prices seem to have mildly plateaued. Home ownership may be possible soon, position yourself for such an event now if that's what you desire.

__________________

casual notes from the underground:There are some "experts" out there that in reality don't have a clue as to what they are doing.

|

|

|

|

05-02-2022, 01:56 PM

05-02-2022, 01:56 PM

|

#34 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,981

Thanks: 4,370

Thanked 4,530 Times in 3,482 Posts

|

Real estate prices are usually sticky, meaning they tend to level off rather than go down in price.

That said, housing prices should follow inflation very closely, and any time it rises much above inflation, it's a bubble.

Either inflation will match the rise in housing costs and therefore it's not a housing bubble, or housing prices will decrease in response to the bubble. The coming recession should increase housing inventory as people consolidate to reduce their expenses.

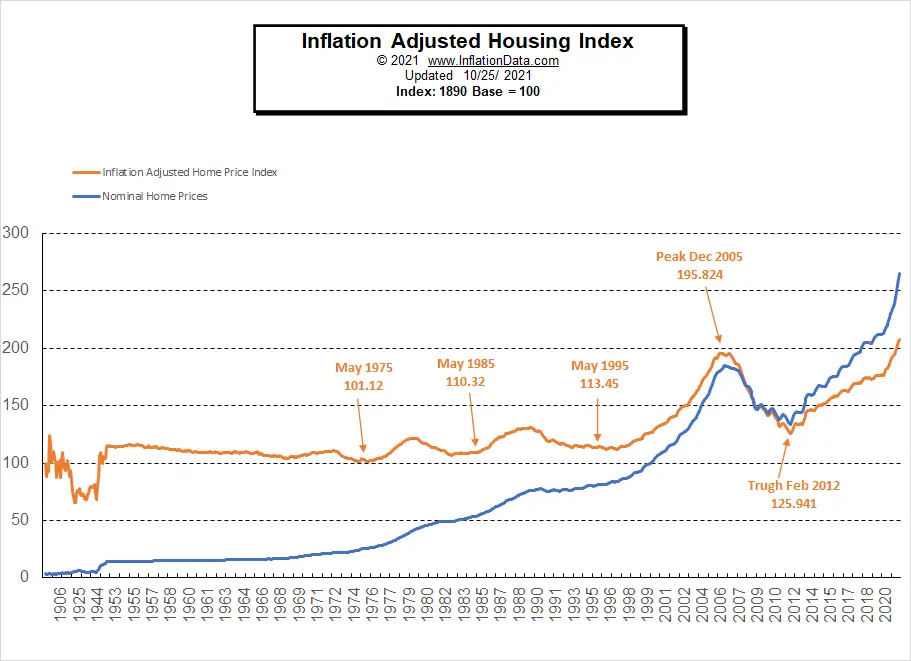

This chart shows house prices really only had a significant drop once in the last 60 years, when the housing bubble burst. We see another bubble forming, but it's hard to say if that's a bubble or inflation.

This chart shows home cost adjusted for inflation (orange line). It should remain relatively flat, but as you see from 2012 on it's been headed up, and much more so in the past couple years. It seems to indicate a bubble of similar size as the previous one.

My take; Wages will catch up to inflation, but there's lag in that process. Meanwhile house prices will decrease, but only slightly. As interest rates rise, house prices must fall in response.

While impossible to predict, it's better to purchase a house when prices are low rather than when interest rates are low. You can always refinance the interest rate when it goes lower, but you cannot refinance the principal cost of the house. |

|

|

|

|

The Following User Says Thank You to redpoint5 For This Useful Post:

|

|

05-02-2022, 03:19 PM

05-02-2022, 03:19 PM

|

#35 (permalink)

|

|

Somewhat crazed

Join Date: Sep 2013

Location: 1826 miles WSW of Normal

Posts: 4,540

Thanks: 582

Thanked 1,239 Times in 1,094 Posts

|

Eloquently stated.

I anticipate housing prices to stabilize due to higher interest rates, but income will increase from inflation thus allowing easier qualification for the loan. At some point during the recession, sales fall and while the value of the house may increase there may be an increase of anxious owners wishing to divest. This is the point to go house shopping and having ones house purchase ducks aligned enhances that prospect.

Having stable or declining expenses while your income increases is a good strategy even if hampered by inflation.

__________________

casual notes from the underground:There are some "experts" out there that in reality don't have a clue as to what they are doing.

|

|

|

|

|

The Following 2 Users Say Thank You to Piotrsko For This Useful Post:

|

|

05-02-2022, 04:19 PM

05-02-2022, 04:19 PM

|

#36 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,981

Thanks: 4,370

Thanked 4,530 Times in 3,482 Posts

|

I presented my hypothesis to my economist friend, and here was his take;

I'm a bit skeptical of the housing bubble. Here is another chart, national income (left axis) and housing prices (right axis):

Note that the spike in home prices and the spike in income happen at the same time. Also note that this isn't perfect since it is aggregate and the reality is that a large portion of people that were likely already wealthy/homeowners saw their incomes increase and expenses decrease during the pandemic. Lots of money to spend on a nice new house in the suburbs (or a vacation home!). We've also seen a lot of people moving from high priced areas like Seattle/San Francisco to less expensive areas like Spokane as they can now work from home. Or perhaps they want to retire somewhere with a lower cost of living.

House price growth seems to be driven by a few factors during the pandemic: significant growth in incomes, housing production (already low) slowing down during the pandemic, and people moved out of urban cores (all of the amenities of living in urban areas went away when you couldn't go to restaurants/bars/shows/etc.). All "fundamental" reasons.

I also think that a lot of developers have priced in the interest rate hikes into their models. So development might be lower than previously anticipated, but should continue to grow. We are still significantly underbuilt in a number of areas, vacancy rates are low, and people are able to make payments (delinquencies haven't really increased).

As an aside I got asked to do a report on if we were in a bubble in 2015/2016 and came of with this (inflation adjusted) cool graph:

I haven't updated it in years, but suspect it would show we are in the ballpark of being properly valued due to the spike in incomes. But for a counterpoint, this is interesting: https://www.dallasfed.org/research/e...m_campaign=dfe |

|

|

|

|

The Following 3 Users Say Thank You to redpoint5 For This Useful Post:

|

|

05-03-2022, 11:15 AM

05-03-2022, 11:15 AM

|

#37 (permalink)

|

|

Somewhat crazed

Join Date: Sep 2013

Location: 1826 miles WSW of Normal

Posts: 4,540

Thanks: 582

Thanked 1,239 Times in 1,094 Posts

|

Good data again. Being a contrarian, I liked the dallas fed counterpoint, but generally, the consensus is " I dunno" and I am fine with that. I can only rely on observations garnered from buying and selling six houses during the period from 1978 to today including bubbles and crashes.

So once again, I suggest preperations for any advantageous movement. I don't recall any egregious costs to get a qualification letter from a finance company other than my time.

__________________

casual notes from the underground:There are some "experts" out there that in reality don't have a clue as to what they are doing.

Last edited by Piotrsko; 05-03-2022 at 11:22 AM..

|

|

|

|

|

The Following User Says Thank You to Piotrsko For This Useful Post:

|

|

05-03-2022, 12:24 PM

05-03-2022, 12:24 PM

|

#38 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,618

Thanks: 329

Thanked 2,167 Times in 1,465 Posts

|

Quote:

Originally Posted by Piotrsko

Good data again. Being a contrarian, I liked the dallas fed counterpoint, but generally, the consensus is " I dunno" and I am fine with that. I can only rely on observations garnered from buying and selling six houses during the period from 1978 to today including bubbles and crashes.

So once again, I suggest preperations for any advantageous movement. I don't recall any egregious costs to get a qualification letter from a finance company other than my time.

|

Time and a ding on your credit to get preapproved. Preapprovals are also only good for a certain number of months - I forget if mine were 3 months or 6. |

|

|

|

05-03-2022, 12:34 PM

05-03-2022, 12:34 PM

|

#39 (permalink)

|

|

home of the odd vehicles

Join Date: Jun 2008

Location: Somewhere in WI

Posts: 3,892

Thanks: 506

Thanked 868 Times in 654 Posts

|

Wage growth vrs initial income looks like an upside down bell curve in terms of your starting point.

Wage growth has primarily been on the very low and very high income brackets with not quite inflation level growth in the so called middle class.

Homes cannot mirror inflation unless wages move in tandem which never happens to the lower brackets.

Young professionals (engineering, IT, technical) have not had uniform increases in their job prospects, I deal with my old engineering college And most recent graduates are not able to find work in their field.

The job expansion has been mostly amongst yet again hospitality, elder care, food, delivery and other worthless professions that can’t pay bills.

The old adage you gotta have a job to get one is in full effect for real jobs and workplaces are still using computerized filtering to give the

“Nobody is applying “ excuse despite record numbers of applicants.

The reality is most job postings are optimistic for underpaid 30 year super qualified people that don’t actually exist, businesses are basically horse trading from the same limited group of individuals. And that group shrinks everyday as millions of the elderly that should have retired 1-2 decades ago leave the workforce, while simultaneously not being replaced.

Already in 2019 based on the shipping industry (those who know the dirty laundry) we were heading for recession, this strange couple years has mixed things up but I fully expect those in the middle to upper middle to start loosing work next year, there simply aren’t the fundamentals to support a continued expansion there.

Housing reductions will follow , typically a bubble like we are in takes about 5 years to burst, the rapid onset and unusual trajectory

(only foreign,corporate, investors and the upper 1/3 have purchased, with mainstream buyers notably abscent )

will make this one strange as the bottom falls out from government bailed out cash flush corporate/institutional land owners not able to collect their necessary rent levels.

What I find more strange is despite the trillion dollar shadow bank bailout of 2020, literally no one seems to be paying attention, these entities instead of learning are doubling down modifying our market fundamentals.

This type of mass corporate and foreign land ownership manipulation isn’t sustainable and our government couldn’t care less.

Hopefully when this all shakes out we DONT bail out the dumb *******s, let the market deflate and change law to heavily restrict and ban mass ownership by foreign, institutional and corporate interests like every other 1st world nation.

If we don’t the bottom 50% won’t be able to rent or buy homes which should cause a continued market failure

Last edited by rmay635703; 05-03-2022 at 01:06 PM..

|

|

|

|

05-03-2022, 01:31 PM

05-03-2022, 01:31 PM

|

#40 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,618

Thanks: 329

Thanked 2,167 Times in 1,465 Posts

|

Quote:

Originally Posted by rmay635703

Young professionals (engineering, IT, technical) have not had uniform increases in their job prospects, I deal with my old engineering college And most recent graduates are not able to find work in their field.

The job expansion has been mostly amongst yet again hospitality, elder care, food, delivery and other worthless professions that canít pay bills.

|

I'm curious what type of engineers you are seeing struggling to find jobs. My first question is are they willing to relocate to hot job markets.

We have hired a few hundred engineers in the past few years and struggled to find candidates and we are fine with taking a new grad with zero engineering job experience. (Zero job experience of any kind is a red flag and I'm shocked at how many 23-24 year-old college grads have never worked a job for a paycheck)

It is also shocking how many absolutely bomb the first interview. Late, Zero enthusiasm, zero knowledge of the company, zero ability to coherently answer a simple interview question like "When you are faced with a problem, what do you do?"

My wife had an interview candidate flat out say they didn't want the job.

Q: Why are you interested in working for our company?

A: I'm not - my parents said I had to get a job.

|

|

|

|

|