Quote:

Originally Posted by redpoint5

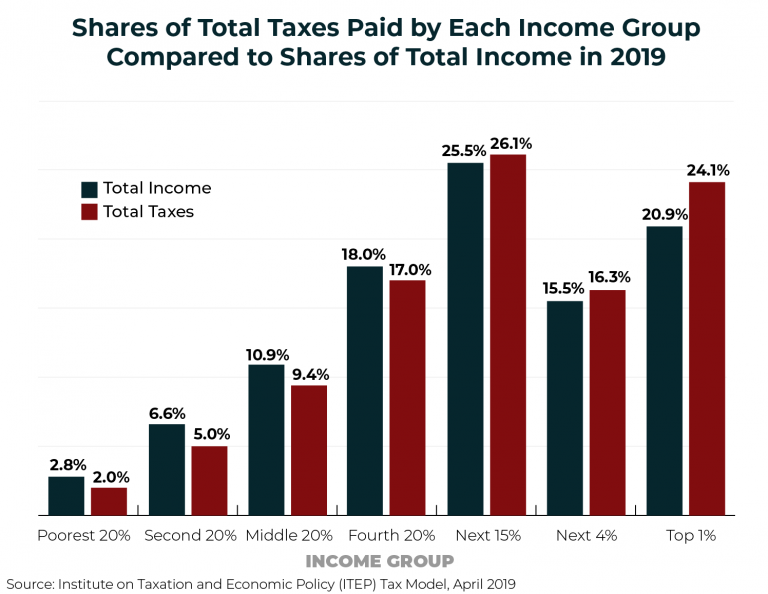

Over half of US households pay ZERO federal tax.

|

Incorrect. It varies each year but generally 45 - 50% of US households pay not federal

INCOME TAX. In 2021 that jumped to 57% due to the pandemic stimulus bills. In 2022 it dropped to 42%. However, most people still paying federal taxes - just not income taxes.

The vast majority of people are paying federal taxes because the USA collects 15.3% FICA taxes from dollar #1. You pay that flat rate on every dollar until $160K and then the rate drops to 0% for no real good reason.

Less than 20% of US household pay no federal taxes at all. Federal tax rates by income brackets below

Quote:

Originally Posted by redpoint5

The confusion comes from the fact that folks don't know that the uber-wealthy have almost all their wealth invested in their portion of the companies they own. Elon is fantastically wealthy because Tesla stock is so high. If Tesla stock plummets, there goes the wealth. The wealthy continuously gamble their wealth back into ideas, which either succeed or fail. They expand the pie that everyone eats from (or more often, fail). You don't tax unrealized gains, because they could be gone tomorrow.

|

Elon is a good example of why people get so upset with the tax system as it relates to the top 5% Yes, Musk's earnings are technically unrealized, but he still lives on them. Instead of cashing out shares to fund his day to day living he takes out loans against his Tesla stock. He lives on that loaned money and then takes another loan to pay it off. That way he can avoid paying that tax man. He is living on the value of his stock - but never paying taxes on it.

Then there is the fact that even if he had to cash out some stock the highest long term capital gains rate is only 20% - which is less than the 22% federal income tax rate for income between $44K and $95K.

Then there is the fact that capital gains, dividends and rental income are not subject to FICA taxes, so while the regular Joe is paying 15.3% on every dollar of his W2 income the investor class don't need to pay the same 15.3%.

Federal taxes are progressive until you get to the top 5% - and then the effective tax rate plummets as the majority of income shifts from W2 wages to investments.