11-24-2023, 03:33 PM

11-24-2023, 03:33 PM

|

#21 (permalink)

|

|

Master EcoModder

Join Date: Dec 2011

Location: New Zealand

Posts: 5,144

Thanks: 2,931

Thanked 2,604 Times in 1,619 Posts

|

Quote:

Originally Posted by JSH

As is the case in most of the rich world. The USA is an incredibly wealthy country but the average US citizens live worse off than their counterparts around the world. The USA is also the most individually focused country. We simply do not work together even when the outcome would be better.

I'd be interested in a "How I moved to New Zealand" thread. I'm sure it isn't as simple as booking a ticket. My wife and I have been looking at early retirement locations and have visited 6 countries to date.

|

I'll probably make just such a thread in the lounge, in that case.

No, moving here isn't a easy as buying a ticket, but it's far easier than moving to the US from anywhere else.

|

|

|

|

Today Today

|

|

|

|

Other popular topics in this forum...

Other popular topics in this forum...

|

|

|

|

11-24-2023, 03:44 PM

11-24-2023, 03:44 PM

|

#22 (permalink)

|

|

Master EcoModder

Join Date: Dec 2011

Location: New Zealand

Posts: 5,144

Thanks: 2,931

Thanked 2,604 Times in 1,619 Posts

|

Quote:

Originally Posted by redpoint5

I've always complained about the avocado cartel in the US. Anywhere else in the world and you're paying $5 for a burlap bag full of 'em. Once here, you're paying $5 for an organic avocado at Whole Foods.

You've explained the game. If you're wealthy, live in the US. If you're average, live on the wealth of the wealthy in New Zealand. Very gameable. If I were middling, I'd be looking at Norway or New Zealand. No wonder why innovation comes from the US, the incentive is there.

|

That's one way to put it. The question then becomes, where is the crossover point? And, where is the wealth generated? Is it the CEOs, or the American workers? Or, somewhere else entirely?

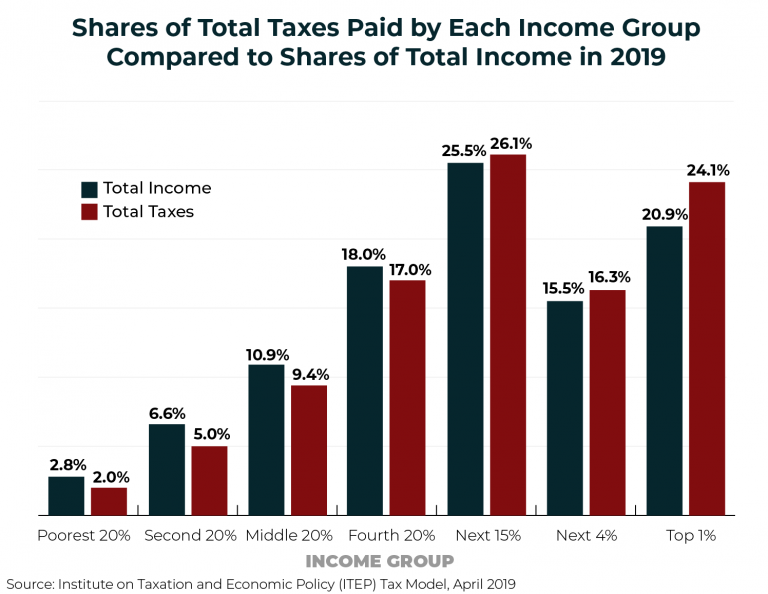

A slightly different way of looking at it is this - in the US, taxes and the cost of goods are collected from everyone who works or buys, and when redistributed primarily go to the top couple of percent. How much do you have to make before you get back less than you pay out?

Last edited by Ecky; 11-24-2023 at 04:05 PM..

|

|

|

|

11-24-2023, 04:19 PM

11-24-2023, 04:19 PM

|

#23 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 13,054

Thanks: 4,381

Thanked 4,564 Times in 3,509 Posts

|

Quote:

Originally Posted by Ecky

The question then becomes, where is the crossover point?

|

Hard to say, and depends on cultural values. Should we extend equity to encompass the world? If so, any household making more than ~$35k is in the top 1%, and should have their privileged wealth redistributed to "the oppressed".

My values tend to be rooted in ancient philosophy, and are along the lines of developing personal relationships and care for those in the community. This is practiced voluntarily, not compelled by threat of violence. Politically, authority is distributed as locally as feasible, with little authority or money residing with the federal government. Nobody cares who is POTUS because they don't really affect anything locally because they are focused on diplomatic relations and national border security, and not gender pronouns and wealth transfers to those who made poor decisions to "invest" in their "education".

Quote:

|

And, where is the wealth generated? Is it the CEOs, or the American workers? Or, somewhere else entirely?

|

Wealth is generated from a system that encourages liberal mindsets to take risks that usually result in failure, but sometimes result in success. The system encourages risk-taking by protecting individuals from permanent catastrophe when their bad ideas fail (bankruptcy). The business can fail, but the individual doesn't have to become an indentured servant to pay back the loss. The investors take the loss or the gain.

The workers maintain the good ideas (conservative by nature), producing goods and services of value. They practice and perfect the good ideas, adhering to the specifications and best practices.

Quote:

|

A slightly different way of looking at it is this - in the US, taxes and the cost of goods are taken from everyone, and primarily given to the top couple of percent. How much do you have to make before you get back less than you pay out?

|

Your assertion is a contradiction. You state everyone pays, and the top earners primarily benefit from that payment. Then you suggest that at some higher income threshold, one pays more than they benefit.

The latter is correct, and the former incorrect. Over half of US households pay ZERO federal tax. Who isn't paying their fare share again? Could it be the majority of people? Who relies on the services rendered by taxes? Is it wealthy people going to the ER when they get the sniffles and then don't pay the bill? Are they the ones mugging people in the streets? Are they the ones cutting catalytic converters off cars?

The top 1% of US taxpayers pay 42% of taxes.

https://taxfoundation.org/data/all/f...a-2023-update/

The confusion comes from the fact that folks don't know that the uber-wealthy have almost all their wealth invested in their portion of the companies they own. Elon is fantastically wealthy because Tesla stock is so high. If Tesla stock plummets, there goes the wealth. The wealthy continuously gamble their wealth back into ideas, which either succeed or fail. They expand the pie that everyone eats from (or more often, fail). You don't tax unrealized gains, because they could be gone tomorrow.

The US system is far from perfect, but it is among the best system for innovation. Tax code and healthcare are at the top of the list of systems needing major simplification, primarily to cut overhead costs and reduce the footprint for corruption.

Last edited by redpoint5; 11-24-2023 at 04:41 PM..

|

|

|

|

|

The Following User Says Thank You to redpoint5 For This Useful Post:

|

|

11-24-2023, 04:22 PM

11-24-2023, 04:22 PM

|

#24 (permalink)

|

|

Master EcoModder

Join Date: Aug 2012

Location: northwest of normal

Posts: 29,458

Thanks: 8,383

Thanked 9,141 Times in 7,547 Posts

|

Quote:

|

And, where is the wealth generated? Is it the CEOs, or the American workers? Or, somewhere else entirely?

|

Wealth or value? Wealth in the stock market, value in AGI.

What comes after LLMs? -- Anastasi In Tech -- 04:24 - AI Stocks to watch

This is why management of OpenAI was running around with their hair on fire. ....and Micro$oft stepped in and took the whole thing without firing a shot.

__________________

.

.Without freedom of speech we wouldn't know who all the idiots are. -- anonymous poster

___________________

.

.Necessity is the mother of invention, but simplicity is it's favorite aunt --Amish proverb

|

|

|

|

11-24-2023, 05:12 PM

11-24-2023, 05:12 PM

|

#25 (permalink)

|

|

Master EcoModder

Join Date: Dec 2011

Location: New Zealand

Posts: 5,144

Thanks: 2,931

Thanked 2,604 Times in 1,619 Posts

|

Quote:

Originally Posted by freebeard

|

This is a solid point.

Disregarding the fact that the median Kiwi has twice as much wealth as the median American, consider the following:

-If an American road is 30% wider, and costs 30% more to make, and 30% more to upkeep, where does this fit into wealth vs value? It certainly contributes to America's measured wealth.

-If the typical American refrigerator has twice the interior volume of the typical Kiwi refrigerator, and costs twice as much, how does this contribute to the typical American's wealth vs value?

-If the typical American bathroom has 50% more area, and costs 30% more to build, what does this say about American wealth vs value, if this is another piece of what is measured?

-If the entry-level beater in America is now a $5,000 US car, but the $1000(US) beater is alive and well in NZ (for essentially the same car), that makes the American with the same beater 5x more wealthy. |

|

|

|

|

The Following User Says Thank You to Ecky For This Useful Post:

|

|

11-24-2023, 07:27 PM

11-24-2023, 07:27 PM

|

#26 (permalink)

|

|

Master EcoModder

Join Date: Dec 2011

Location: New Zealand

Posts: 5,144

Thanks: 2,931

Thanked 2,604 Times in 1,619 Posts

|

Quote:

Originally Posted by redpoint5

Hard to say, and depends on cultural values. Should we extend equity to encompass the world? If so, any household making more than ~$35k is in the top 1%, and should have their privileged wealth redistributed to "the oppressed".

My values tend to be rooted in ancient philosophy, and are along the lines of developing personal relationships and care for those in the community. This is practiced voluntarily, not compelled by threat of violence. Politically, authority is distributed as locally as feasible, with little authority or money residing with the federal government. Nobody cares who is POTUS because they don't really affect anything locally because they are focused on diplomatic relations and national border security, and not gender pronouns and wealth transfers to those who made poor decisions to "invest" in their "education".

|

I didn't mean that as a matter of judgement, but rather as a practical consideration. More specifically - if you pay X taxes in the US and Y taxes somewhere else, the crossover point at which you're giving more than you're getting will be at A income (or position in the socioeconomic ladder) in the US and B income or point at the other location.

In more specific terms, is the $75,000(US) income earner a net contributor or burden to the system? $40,000? $200,000? What is the crossoverpoint, above which you're better off providing things for yourself than relying on pooled and redistributed communal resources?

This of course leaves out entirely the economies of scale or efficiency of said systems.

Quote:

Originally Posted by redpoint5

Wealth is generated from a system that encourages liberal mindsets to take risks that usually result in failure, but sometimes result in success. The system encourages risk-taking by protecting individuals from permanent catastrophe when their bad ideas fail (bankruptcy). The business can fail, but the individual doesn't have to become an indentured servant to pay back the loss. The investors take the loss or the gain.

The workers maintain the good ideas (conservative by nature), producing goods and services of value. They practice and perfect the good ideas, adhering to the specifications and best practices.

|

Granted.

This is rather multifaceted, however. New Zealand has 3x as many business owners per capita, because it's easier to start a business, and there are more robust legal protections in place to prevent large businesses from drowning small businesses through means outside of pure competitive advantrage. The US however has far greater ability to scale up.

Quote:

Originally Posted by redpoint5

Your assertion is a contradiction. You state everyone pays, and the top earners primarily benefit from that payment. Then you suggest that at some higher income threshold, one pays more than they benefit.

The latter is correct, and the former incorrect. Over half of US households pay ZERO federal tax. Who isn't paying their fare share again? Could it be the majority of people? Who relies on the services rendered by taxes? Is it wealthy people going to the ER when they get the sniffles and then don't pay the bill? Are they the ones mugging people in the streets? Are they the ones cutting catalytic converters off cars?

The top 1% of US taxpayers pay 42% of taxes.

https://taxfoundation.org/data/all/f...a-2023-update/

The confusion comes from the fact that folks don't know that the uber-wealthy have almost all their wealth invested in their portion of the companies they own. Elon is fantastically wealthy because Tesla stock is so high. If Tesla stock plummets, there goes the wealth. The wealthy continuously gamble their wealth back into ideas, which either succeed or fail. They expand the pie that everyone eats from (or more often, fail). You don't tax unrealized gains, because they could be gone tomorrow.

The US system is far from perfect, but it is among the best system for innovation. Tax code and healthcare are at the top of the list of systems needing major simplification, primarily to cut overhead costs and reduce the footprint for corruption. |

I'm asking these questions not in a pointed way, but in a way to hopefully educate me in particular.

Being pedantic, but a quick search suggests the ratio is just under 40% of households which paid no federal individual income tax - which is still a disturbingly high number. I'd guess a portion of these are students, and a portion are welfare and/or disabled.

Perhaps the question I ought to be asking is, why is the laborforce participation so much lower in the US (approximately 15% lower)? Why is the unemployment rate (of those seeking to join) higher? You and I both know it isn't because the bottom half of Americans are more lazy and/or stupid than their peers overseas.

I risk derailing the topic here, but you also have the incontrovertible fact that national spending is broken down quite differently. NZ and the US spend similar portions of their GDP, but where it goes is quite different. As a portion of spending, New Zealand puts around 4x as much into education, while healthcare spending is actually lower as a percent despite the system covering everyone.

~

All said, while I appreciate that the US is an engine of innovation and production, on an individual level, my life is considerably better here, and the system is both apparently more stable and sustainable.

Last edited by Ecky; 11-24-2023 at 07:35 PM..

|

|

|

|

|

The Following User Says Thank You to Ecky For This Useful Post:

|

|

11-24-2023, 08:23 PM

11-24-2023, 08:23 PM

|

#27 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,625

Thanks: 331

Thanked 2,171 Times in 1,468 Posts

|

Quote:

Originally Posted by redpoint5

Over half of US households pay ZERO federal tax.

|

Incorrect. It varies each year but generally 45 - 50% of US households pay not federal INCOME TAX. In 2021 that jumped to 57% due to the pandemic stimulus bills. In 2022 it dropped to 42%. However, most people still paying federal taxes - just not income taxes.

The vast majority of people are paying federal taxes because the USA collects 15.3% FICA taxes from dollar #1. You pay that flat rate on every dollar until $160K and then the rate drops to 0% for no real good reason.

Less than 20% of US household pay no federal taxes at all. Federal tax rates by income brackets below

Quote:

Originally Posted by redpoint5

The confusion comes from the fact that folks don't know that the uber-wealthy have almost all their wealth invested in their portion of the companies they own. Elon is fantastically wealthy because Tesla stock is so high. If Tesla stock plummets, there goes the wealth. The wealthy continuously gamble their wealth back into ideas, which either succeed or fail. They expand the pie that everyone eats from (or more often, fail). You don't tax unrealized gains, because they could be gone tomorrow.

|

Elon is a good example of why people get so upset with the tax system as it relates to the top 5% Yes, Musk's earnings are technically unrealized, but he still lives on them. Instead of cashing out shares to fund his day to day living he takes out loans against his Tesla stock. He lives on that loaned money and then takes another loan to pay it off. That way he can avoid paying that tax man. He is living on the value of his stock - but never paying taxes on it.

Then there is the fact that even if he had to cash out some stock the highest long term capital gains rate is only 20% - which is less than the 22% federal income tax rate for income between $44K and $95K.

Then there is the fact that capital gains, dividends and rental income are not subject to FICA taxes, so while the regular Joe is paying 15.3% on every dollar of his W2 income the investor class don't need to pay the same 15.3%.

Federal taxes are progressive until you get to the top 5% - and then the effective tax rate plummets as the majority of income shifts from W2 wages to investments.

|

|

|

|

|

The Following 2 Users Say Thank You to JSH For This Useful Post:

|

|

11-25-2023, 01:20 AM

11-25-2023, 01:20 AM

|

#28 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 13,054

Thanks: 4,381

Thanked 4,564 Times in 3,509 Posts

|

Quote:

Originally Posted by Ecky

if you pay X taxes in the US and Y taxes somewhere else, the crossover point at which you're giving more than you're getting will be at A income (or position in the socioeconomic ladder) in the US and B income or point at the other location.

|

I was entirely confused before you clarified here. I still suspect that generally a wealthy person has an advantage in the US, and the average to low earner is advantaged in NZ.

Quote:

|

In more specific terms, is the $75,000(US) income earner a net contributor or burden to the system? $40,000? $200,000? What is the crossoverpoint, above which you're better off providing things for yourself than relying on pooled and redistributed communal resources?

|

Good questions, and I don't know... my guess is a single earner making $75k is at just about break-even on paying vs taking from the system.

Quote:

|

This is rather multifaceted, however. New Zealand has 3x as many business owners per capita, because it's easier to start a business, and there are more robust legal protections in place to prevent large businesses from drowning small businesses through means outside of pure competitive advantrage. The US however has far greater ability to scale up.

|

I have no insight into the differences in the systems. That said, nature has imposed an insidious rule that the big get ever bigger. A successful business growing to become the most successful by far isn't caused by system structure, but simply a manifestation of nature. Preventing nature from imposing her rules is the exception, and it doesn't end well. Reality always demands repayment.

100% of big businesses were once small businesses. Remember when Amazon was a business that sold used books? Remember when Facebook was for college students and "friends" could only be people that go to your college?

Quote:

|

Being pedantic, but a quick search suggests the ratio is just under 40% of households which paid no federal individual income tax - which is still a disturbingly high number. I'd guess a portion of these are students, and a portion are welfare and/or disabled.

|

I got that fact from a couple years ago. Numbers shift, but apparently a large number still pay no net federal income tax.

Quote:

|

Perhaps the question I ought to be asking is, why is the laborforce participation so much lower in the US (approximately 15% lower)? Why is the unemployment rate (of those seeking to join) higher? You and I both know it isn't because the bottom half of Americans are more lazy and/or stupid than their peers overseas.

|

Circumstance and cultural values answers most discrepancies. NZ has a population just a bit larger than Oregon, and is an island. The smaller the community and the more isolated they are, the more tightknit the tribe.

I flew to Nicaragua once, and it was the most corrupt and dog-eat-dog culture I had ever encountered. Then I traveled to Little Corn Island, a tiny dot in Nicaragua, and it was the highest trust, least corrupt society I've ever encountered. 4 of us are paying $12 a night for a hut, and our $1,000 cameras or laptops are safe in an unlocked shack. A local couldn't provide change for a large denomination of cash I used to pay for breakfast, and they said no worries, pay later when I have smaller cash (which I did later that day).

When there aren't unlimited people to abuse, trust becomes crucial (proved by my experience in prison).

Quote:

|

I risk derailing the topic here, but you also have the incontrovertible fact that national spending is broken down quite differently. NZ and the US spend similar portions of their GDP, but where it goes is quite different. As a portion of spending, New Zealand puts around 4x as much into education, while healthcare spending is actually lower as a percent despite the system covering everyone.

|

"Education" is primarily a cultural value. If the culture doesn't value it, no amount of cash will fix the problem. 99.9% of knowledge is free to learn from the internet, but is meaningless if people don't value it.

US healthcare is the worst combination of socialism and capitalism. Profit motivates many decisions that are adverse to patient care or cost, and socialism removes the incentive to seek the best value for the dollar. Who cares what something costs when someone else is paying the bill, and who cares what something costs when one has no intention of ever paying the bill. As long as we're all splitting the bill, I'm having prime rib, the expensive bottle of wine, and desert.

Quote:

|

All said, while I appreciate that the US is an engine of innovation and production, on an individual level, my life is considerably better here, and the system is both apparently more stable and sustainable.

|

NZ is entirely dependent on western superpowers for stability. It's "sustainable" because nobody has any interest in conquering an island with a population a bit larger than Oregon. The Oregon National Guard probably has the capability to conquer the NZ national defense... because it relies on western nations for protection.

No doubt island living is less stress than a melting pot of 330 million people. Bigger things make bigger mistakes. Bigger things make bigger discoveries. Bigger things have a harder time defining an identity.

Quote:

Originally Posted by JSH

The vast majority of people are paying federal taxes because the USA collects 15.3% FICA taxes from dollar #1.

|

I feel that you're purposely misrepresenting the meaning of what I've said. A forced "savings" account is not really a tax. You pay in, and you get it back out. I'm specifically excluding entitlement taxes as they are regarded as deferred payment.

Who pays even $1 for the war department? The department of miseducation? IRS? FBI? TSA gropers? Billions for war in Ukraine? Failed Iran bribery? Massive inflation? Less than half of households is the answer.

Quote:

|

Elon is a good example of why people get so upset with the tax system as it relates to the top 5% Yes, Musk's earnings are technically unrealized, but he still lives on them. Instead of cashing out shares to fund his day to day living he takes out loans against his Tesla stock.

|

Loans require an interest to be paid. When that interest is paid, it is counted as profit and taxed.

Quote:

Then there is the fact that even if he had to cash out some stock the highest long term capital gains rate is only 20% - which is less than the 22% federal income tax rate for income between $44K and $95K.

Then there is the fact that capital gains, dividends and rental income are not subject to FICA taxes, so while the regular Joe is paying 15.3% on every dollar of his W2 income the investor class don't need to pay the same 15.3%.

|

You're making my point about the tax code being corrupt, and in need of massive simplification.

Quote:

|

Federal taxes are progressive until you get to the top 5% - and then the effective tax rate plummets as the majority of income shifts from W2 wages to investments.

|

You're making my point that the US has prioritized innovation. Gambling is what we're good at. Big winners, and big losers. The majority of us somewhere between the extremes. Nobody dying of hunger, because we're a society that doesn't tolerate it.

Last edited by redpoint5; 11-25-2023 at 01:53 AM..

|

|

|

|

11-25-2023, 08:32 AM

11-25-2023, 08:32 AM

|

#29 (permalink)

|

|

EcoModding Lurker

Join Date: Nov 2023

Location: Mt. Shasta, CA

Posts: 4

Thanks: 0

Thanked 2 Times in 2 Posts

|

I'm about to ecomod a 1994 Honda Del Sol, by looking around for and then installing a Civic VX Transmission that will make it turn lower RPMs on the highway.

|

|

|

|

|

The Following User Says Thank You to Engine1776 For This Useful Post:

|

|

11-25-2023, 03:17 PM

11-25-2023, 03:17 PM

|

#30 (permalink)

|

|

Master EcoModder

Join Date: Dec 2011

Location: New Zealand

Posts: 5,144

Thanks: 2,931

Thanked 2,604 Times in 1,619 Posts

|

Quote:

Originally Posted by Engine1776

I'm about to ecomod a 1994 Honda Del Sol, by looking around for and then installing a Civic VX Transmission that will make it turn lower RPMs on the highway.

|

I had a Del Sol when I was younger. Even with a B series engine turning 4500rpm on the highway, it still averaged around 36mpg. I'd wager the D15 with gearing swap would be mid to high 40's.

|

|

|

|

|