10-07-2020, 09:58 PM

10-07-2020, 09:58 PM

|

#641 (permalink)

|

|

Master EcoModder

Join Date: Aug 2012

Location: northwest of normal

Posts: 28,773

Thanks: 8,173

Thanked 8,949 Times in 7,391 Posts

|

"Doooo Eeeeet." X2.

But, https://20somethingfinance.com/elect...dits-by-state/

Quote:

Oregon

As of late 2019, Oregon’s electric vehicle rebates are now:

Standard Rebate:

$2,500 towards the purchase or lease of a new plug-in hybrid electric vehicle or battery electric vehicle with a battery capacity of 10 kWh or more.

$1,500 towards the purchase or lease of a new plug-in hybrid electric vehicle or battery electric vehicle with a battery capacity of less than 10 kWh.

$750 towards the purchase or lease of a zero-emission electric motorcycle.

For the Charge Ahead Rebate:

$2,500 towards the purchase or lease of a new or used battery electric vehicle.

Plug-in hybrid electric vehicles purchased on Sept. 29, 2019 or later are also eligible for the Charge Ahead Rebate.

|

I though we'd discussed this before.  My plan is to try to get my son to float a $5K interim loan until the rebate drops. Then I can get a credit union loan to cover what selling off two or three cars doesn't.

The Federal tax credit would be of no value to me, I don't make enough to pay taxes.

edit: Already covered. Carry on.

__________________

.

.Without freedom of speech we wouldn't know who all the idiots are. -- anonymous poster

____________________

.

.Three conspiracy theorists walk into a bar --You can't say that is a coincidence.

|

|

|

|

Today Today

|

|

|

|

Other popular topics in this forum...

Other popular topics in this forum...

|

|

|

|

10-07-2020, 11:14 PM

10-07-2020, 11:14 PM

|

#642 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,834

Thanks: 4,330

Thanked 4,488 Times in 3,451 Posts

|

Businesses don't even have to be official. I depreciated the rental units I had in Enid despite the fact that we never setup an LLC. My partner and I split everything (expenses and income) 50/50 on our personal taxes.

Deductions need to exceed the standard deduction to be worthwhile.

|

|

|

|

10-07-2020, 11:35 PM

10-07-2020, 11:35 PM

|

#643 (permalink)

|

|

Not Doug

Join Date: Jun 2012

Location: Show Low, AZ

Posts: 12,242

Thanks: 7,255

Thanked 2,234 Times in 1,724 Posts

|

People talk about the rich donating to charity just for the tax deduction. People also say that if you win money you pay half in taxes.

People are stupid!

Let's say I win $1,000,000 and bring home a cool $500,000. I then donate all of it for a tax deduction.

Genius! I have no money now, but I have a $250,000 tax return coming!

I never understand my brother's SLPA. She always complains about her boss and pay. She told us that she deducted everything, her new truck, her clothes, her food, etc., because she needs food, clothes, and a vehicle to work!

Yes. Jeans with holes in them. She needs to look her best!

__________________

"Oh if you use math, reason, and logic you will be hated."--OilPan4

|

|

|

|

10-08-2020, 02:17 AM

10-08-2020, 02:17 AM

|

#644 (permalink)

|

|

It's all about Diesel

Join Date: Oct 2012

Location: Porto Alegre, Rio Grande do Sul, Brazil

Posts: 12,923

Thanks: 0

Thanked 1,697 Times in 1,515 Posts

|

Tax law seems to be so complicated that it sounds almost like it was set that way so the average Joe would just shut up and pay instead of spending on a tax attorney only to find out a non-eligibility for a tax break.

|

|

|

|

10-08-2020, 02:38 AM

10-08-2020, 02:38 AM

|

#645 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,834

Thanks: 4,330

Thanked 4,488 Times in 3,451 Posts

|

Quote:

Originally Posted by cRiPpLe_rOoStEr

Tax law seems to be so complicated that it sounds almost like it was set that way so the average Joe would just shut up and pay instead of spending on a tax attorney only to find out a non-eligibility for a tax break.

|

You donít need a tax attorney in the US. If you donít make much money, the IRS isnít going to bother with you, so thereís not much preventing cheating. At worst, you owe due to an audit. The only criminal risk is admitting you meant to defraud the state, since accidents arenít considered illegal. The whole thing is a stupid complicated mess of insanity, but we wonít talk about it because Russian Collusion. |

|

|

|

10-08-2020, 07:00 AM

10-08-2020, 07:00 AM

|

#646 (permalink)

|

|

Rat Racer

Join Date: May 2011

Location: Route 16

Posts: 4,150

Thanks: 1,784

Thanked 1,922 Times in 1,246 Posts

|

Quote:

Originally Posted by redpoint5

No political party will talk about this on the whole though, because they are both playing the same game from different sides.

|

They're on the same side. Their donors are mostly on the same side. Their voters tend not to be, so they try to make it look like thry're on different sides.

Quote:

Originally Posted by Xist

People talk about the rich donating to charity just for the tax deduction.

|

It's not about firing money at generic "charity" for tax reasons, it's about structuring spending that you wanted to do anyway to make it deductible. Hobbies, interests and local advertising suddenly become philanthropy and deductions. This is easier to pull off than trying to set up your hobbies as legitimate business expenses: If you donate enough to your kid's little league team, their shirts will have your hardware store's name on them... and you get a write off. If you like hobnobbing with other rich people at the theater and always having great tickets when a good act comes to town...

__________________

Quote:

Originally Posted by sheepdog44

Transmission type Efficiency

Manual neutral engine off.100% @∞MPG <----- Fun Fact.

Manual 1:1 gear ratio .......98%

CVT belt ............................88%

Automatic .........................86%

|

|

|

|

|

10-08-2020, 01:39 PM

10-08-2020, 01:39 PM

|

#647 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,604

Thanks: 326

Thanked 2,150 Times in 1,455 Posts

|

Quote:

Originally Posted by cRiPpLe_rOoStEr

Tax law seems to be so complicated that it sounds almost like it was set that way so the average Joe would just shut up and pay instead of spending on a tax attorney only to find out a non-eligibility for a tax break.

|

Tax law is complicated because of two basic reasons:

1. If you donate enough money to politicians you can get a special tax exemption, credit, etc written into the tax law to benefit your industry

2. The USA uses tax law to attempt to fix social issues. Direct spending on social programs like welfare is unpopular so instead of sending a poor family a check each month politicians created programs like the Earned Income Tax Credit where we give poor families a tax refund in excess of the taxes they paid. There are lots of social spending buried in the tax code.

Quote:

Originally Posted by Fat Charlie

It's not about firing money at generic "charity" for tax reasons, it's about structuring spending that you wanted to do anyway to make it deductible. Hobbies, interests and local advertising suddenly become philanthropy and deductions. This is easier to pull off than trying to set up your hobbies as legitimate business expenses: If you donate enough to your kid's little league team, their shirts will have your hardware store's name on them... and you get a write off. If you like hobnobbing with other rich people at the theater and always having great tickets when a good act comes to town...

|

Barber Motorsports Park in Leeds Alabama is an excellent example of this. George W. Barber built it and the Barber Museum because he is a huge motorsports fan and collector. So he built a race track and 230,000 sq ft "museum" to house his personal motorcycle and race car collection (about 2,000 vehicles) It is organized as a 501c3 nonprofit so his collecting hobby is tax deductible. The building, the full time mechanics that restore his motorcycles, the new vehicles he buys, etc.

This isn't all bad, the museum is fantastic and open to the public but I doubt that is the primary reason to set it up as a non-profit. |

|

|

|

|

The Following 4 Users Say Thank You to JSH For This Useful Post:

|

|

10-08-2020, 01:47 PM

10-08-2020, 01:47 PM

|

#648 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,834

Thanks: 4,330

Thanked 4,488 Times in 3,451 Posts

|

The far left wants to burn capitalism (free markets), but I want to burn our tax code and start from scratch. Charities should be just that, charities. That means it costs people who donate, and there is no financial incentive, meaning you support it because the cause is worth the cost.

Eliminate the federal income tax and replace with a sales tax. No tax on staple food items. No tax on the first $500/mo spent towards rent or mortgage for a primary dwelling.

Unfortunately I'll have to wait until the far left gets their way and we start over from ashes to realize this noble dream.

|

|

|

|

10-08-2020, 01:53 PM

10-08-2020, 01:53 PM

|

#649 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,604

Thanks: 326

Thanked 2,150 Times in 1,455 Posts

|

Quote:

Originally Posted by redpoint5

Eliminate the federal income tax and replace with a sales tax. No tax on staple food items. No tax on the first $500/mo spent towards rent or mortgage for a primary dwelling.

|

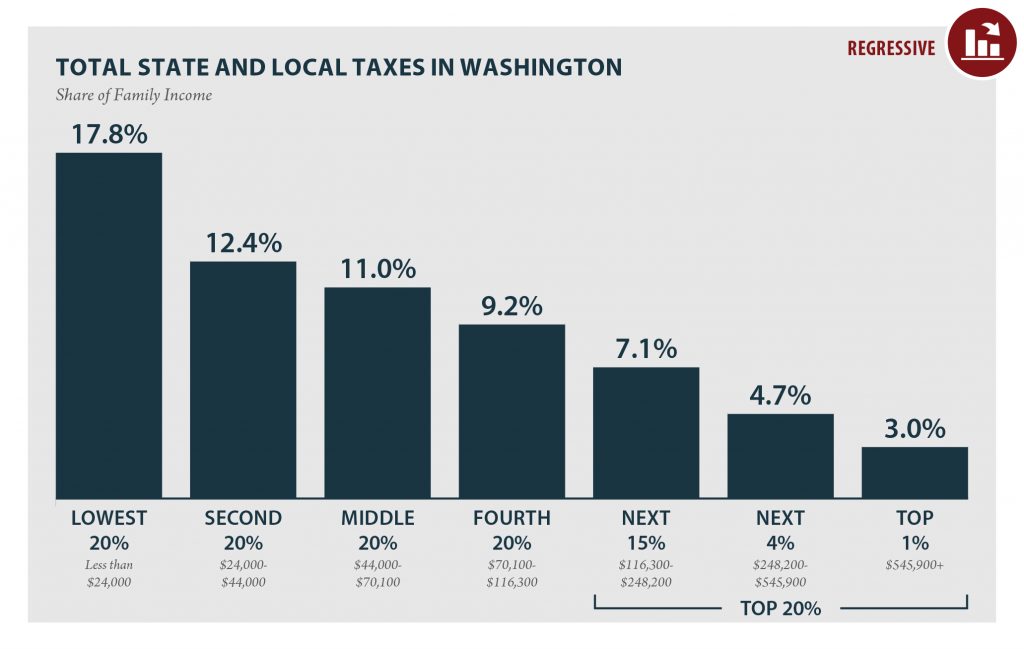

That is the "Fair" Tax plan which is massively regressive.

Washington State is another example of a regressive tax structure based primarily on a sales tax.

|

|

|

|

10-08-2020, 02:53 PM

10-08-2020, 02:53 PM

|

#650 (permalink)

|

|

Batman Junior

Join Date: Nov 2007

Location: 1000 Islands, Ontario, Canada

Posts: 22,534

Thanks: 4,082

Thanked 6,979 Times in 3,614 Posts

|

Enough with the tax talk, thanks. It's veered way past anything related to Arcimoto now.

|

|

|

|

|

The Following 2 Users Say Thank You to MetroMPG For This Useful Post:

|

|

|