03-31-2019, 03:47 PM

03-31-2019, 03:47 PM

|

#1021 (permalink)

|

|

Just cruisin’ along

Join Date: Jul 2009

Location: Rochester, NY

Posts: 1,183

Thanks: 66

Thanked 201 Times in 171 Posts

|

If there were an EV which fit into my budget and use, I'd do it just out of curiosity.

They do neither, so yeah, I sorta feel the "rich man's hobby" thing.

__________________

'97 Honda Civic DX Coupe 5MT - dead 2/23

'00 Echo - dead 2/17

'14 Chrysler Town + Country - My DD, for now

'67 Mustang Convertible - gone 1/17

|

|

|

|

Today Today

|

|

|

|

Other popular topics in this forum...

Other popular topics in this forum...

|

|

|

|

03-31-2019, 04:13 PM

03-31-2019, 04:13 PM

|

#1022 (permalink)

|

|

Not Doug

Join Date: Jun 2012

Location: Show Low, AZ

Posts: 12,279

Thanks: 7,279

Thanked 2,238 Times in 1,728 Posts

|

You ignored the part where I spend the time cleaning my windshield and back window. So, ten seconds a day would be on top of cleaning my windows every week.

I have USAA, but I do not know anything about financing vehicles, because I never finance anything. Like I said, if I needed to replace my car, I would pay cash.

3% interest may not be much, but unless I am earning more on the same amount, I am still losing money.

I may be able to get a better deal than 8%, but that is $692 in interest, out of a total of $7,812, or 8.9%.

At 3% it is $12 less a month, $528 less in total, and 6.8% less than my original figure.

Would this McDonald's scenario be on top of your full-time job?

|

|

|

|

03-31-2019, 05:05 PM

03-31-2019, 05:05 PM

|

#1023 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,972

Thanks: 4,364

Thanked 4,530 Times in 3,482 Posts

|

Quote:

Originally Posted by freebeard

I have USAA for insurance and a local credit union for finance.

|

I had all my money in Iowa once because I did a nationwide search for the best rewards checking account, and it was West Bank (Iowa). No problem because I do all my banking online, and have my pay direct deposited. I've never even written a check (except in high school in a life skills class).

When the rates were no longer the best, I online bill paid myself and they sent my money via a check that I then deposited into a different credit union. My current credit union can accept paper checks by using a phone to take a photo to deposit. I then just tear up the check.

My favorite credit union simply for the comedy factor is Redneck Bank. Not bad rates either. I've never held an account with them, but I have a friend that does.

https://redneck.bank/

Quote:

Originally Posted by Xist

You ignored the part where I spend the time cleaning my windshield and back window. So, ten seconds a day would be on top of cleaning my windows every week.

I have USAA, but I do not know anything about financing vehicles, because I never finance anything. Like I said, if I needed to replace my car, I would pay cash.

3% interest may not be much, but unless I am earning more on the same amount, I am still losing money.

I may be able to get a better deal than 8%, but that is $692 in interest, out of a total of $7,812, or 8.9%.

At 3% it is $12 less a month, $528 less in total, and 6.8% less than my original figure.

Would this McDonald's scenario be on top of your full-time job?

|

That Dave Ramsey mentality is too simplistic. It's a great way to think about money if you've got low discipline, but wealthy people make credit work for them to make more. 3% interest to finance a vehicle is lower than 7% you can make in an index fund. In other words, you make more money paying the 3% interest on a vehicle loan when you factor in the money not spent on the vehicle sitting in an index fund.

Not only that, but you need credit to get a mortgage. Why not finance a car at low rates, invest the money not spent on the car in an IRA, and build credit? I've financed cars before even though I could pay cash. The only reason I paid it off early is that financing a vehicle requires comprehensive and collision coverage, which is much more than liability only. I like to run minimum liability coverage.

Give me any scenario and I can probably save money, including McDonalds as my only full time job. I made $30/mo in prison working 40hr weeks, and I came out with an extra $200. I had to pay for my own shoes, soap, shampoo, toothbrush, radio, toothpaste, postage paid envelopes (lopes), ... |

|

|

|

|

The Following 2 Users Say Thank You to redpoint5 For This Useful Post:

|

|

03-31-2019, 06:55 PM

03-31-2019, 06:55 PM

|

#1024 (permalink)

|

|

Rat Racer

Join Date: May 2011

Location: Route 16

Posts: 4,150

Thanks: 1,784

Thanked 1,922 Times in 1,246 Posts

|

Quote:

Originally Posted by Xist

3% interest may not be much, but unless I am earning more on the same amount, I am still losing money.

|

A car that you don't have enough cash to buy outright... is probably more reliable than the tax return-mobiles that my wife and I used to get every year (take the check to the crappy used car lot and see what we'd be driving for the next year).

Going into debt, overall, isn't a good thing. But if you're living paycheck to paycheck, it's almost impossible to buy something bigger than one of your paychecks. I'm pretty thrilled to own my house, which the bank now owns a little less than half of. I'm pretty happy about my car too: it's got 115k and looks a bit ragged, but it's got at least that much more life left in it and it's paid for. I didn't finance it so I could finance something else the moment the payments stopped, I bought it to run a long time, and financing it helped me do it.

__________________

Quote:

Originally Posted by sheepdog44

Transmission type Efficiency

Manual neutral engine off.100% @∞MPG <----- Fun Fact.

Manual 1:1 gear ratio .......98%

CVT belt ............................88%

Automatic .........................86%

|

|

|

|

|

03-31-2019, 07:26 PM

03-31-2019, 07:26 PM

|

#1025 (permalink)

|

|

Master EcoModder

Join Date: Aug 2012

Location: northwest of normal

Posts: 29,149

Thanks: 8,274

Thanked 9,036 Times in 7,467 Posts

|

Quote:

|

I had all my money in Iowa once because I did a nationwide search for the best rewards checking account, and it was West Bank (Iowa). No problem because I do all my banking online, and have my pay direct deposited. I've never even written a check (except in high school in a life skills class).

|

The interesting case is North Dakota

https://en.wikipedia.org/wiki/Bank_of_North_Dakota

Quote:

Organization

Under state law, the bank is the State of North Dakota doing business as the Bank of North Dakota. The state and its agencies are required to place their funds in the bank, but local governments are not required to do so.

History

The Bank of North Dakota was established by legislative action in 1919 to promote agriculture, commerce and industry in North Dakota. Though initially conceived by populists in the Non-Partisan League, or NPL, as a credit union-style institution to free the farmers of the state from predatory lenders, the bank's functions were largely blocked by out-of-state financial actors refusing to buy the bonds the bank issued to finance its lending, lending that would have provided competition to the commercial banks. The business-backed Independent Voters Association then pursued shutting down the bank politically. The recall of NPL Governor Lynn Frazier effectively ended the initial plan, with BND taking a more conservative central banking role in state finance.

|

They tried.

__________________

.

.Without freedom of speech we wouldn't know who all the idiots are. -- anonymous poster

____________________

.

.The wages of woke is broke[™] -- Harvey Cthulhu

|

|

|

|

04-01-2019, 02:12 AM

04-01-2019, 02:12 AM

|

#1026 (permalink)

|

|

Not Doug

Join Date: Jun 2012

Location: Show Low, AZ

Posts: 12,279

Thanks: 7,279

Thanked 2,238 Times in 1,728 Posts

|

I do not think that I have ever heard anything good about Buy Here Pay Here places, although when my sister sold her 2000 Civic, she bought a 1993 Accord from one. She bragged about the great deal she got, but she declared bankruptcy when she still owed a third.

When I was in Page I did a balance transfer to a new USAA card with a 0% introductory rate and I used that card wherever possible while I saved up for a new checking account that would have paid interest, but the job did not work out, and I spent that money on bills.

The nice thing is that they only charge interest on new balances, so I can continue paying down my student loans without paying interest on my credit cards.

I forget what my credit score is. USAA used to tell me each time I logged in, but that is currently off-line. I believe that it was 735.

I was chatting with a woman on-line several months ago. Things seemed to be going well enough. She said something about the brilliant way that she used her credit cards, I asked what she thought of Dave Ramsey, and she went on such a rant that I completely stopped talking to her.

I forget what I have mentioned about him, that his investment advice seems to be completely wrong, and that his snowball method is not ideal. As I recall, I created a thread called "People who do math don't have credit cards."

My math said that I would have fines and fees if I did not use my credit card.

|

|

|

|

04-01-2019, 12:51 PM

04-01-2019, 12:51 PM

|

#1027 (permalink)

|

|

Human Environmentalist

Join Date: Aug 2010

Location: Oregon

Posts: 12,972

Thanks: 4,364

Thanked 4,530 Times in 3,482 Posts

|

... and people that like free money and a good credit score do use credit cards.

Some cards offer 2% cash back on all purchases. I actually paid my wife's tuition with credit cards, which seemed silly that they would accept them, but at $10k every 3 months, I was getting a lot back in rewards and paid off the balance every month, so incurred no interest. To this day, I have never paid any interest on a credit card.

My fallback plan is always a HELOC. If there is a debt that needs to be paid, best to use the equity in my home as the interest rates are the lowest, and also tax deductible.

|

|

|

|

|

The Following 2 Users Say Thank You to redpoint5 For This Useful Post:

|

|

04-01-2019, 03:46 PM

04-01-2019, 03:46 PM

|

#1028 (permalink)

|

|

Master EcoWalker

Join Date: Dec 2012

Location: Nieuwegein, the Netherlands

Posts: 4,003

Thanks: 1,715

Thanked 2,250 Times in 1,457 Posts

|

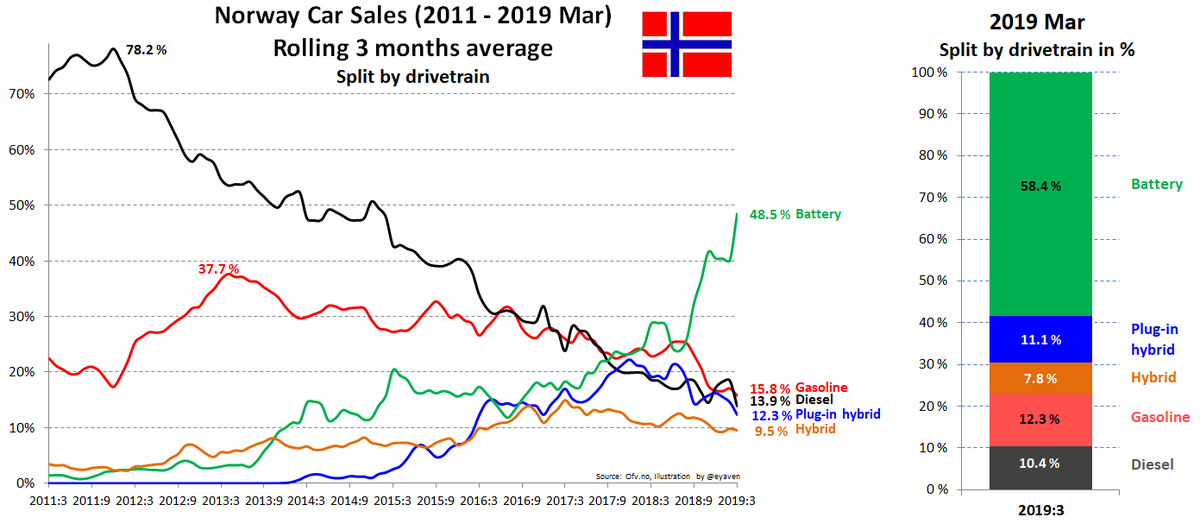

Meanwhile in Norway...

The Model 3 sold 5.315 times in March. That is 1 for every 1,000 Norwegians... At this rate all Norwegian could buy one in their lifetime. Almost 30% of all cars sold this month was a Tesla Model 3. Every single Norwegian monthly EV sales record got broken.

Diesel down from almost 80% 8 years ago to just 10%!!!

Over here in the Netherlands sales were less extreme - the Model 3 was 'only' the best selling car model of the month. Like 'Now you don't see them - now you do'.

__________________

2011 Honda Insight + HID, LEDs, tiny PV panel, extra brake pad return springs, neutral wheel alignment, 44/42 PSI (air), PHEV light (inop), tightened wheel nut.

lifetime FE over 0.2 Gigameter or 0.13 Megamile.

For confirmation go to people just like you.

For education go to people unlike yourself.

|

|

|

|

|

The Following 2 Users Say Thank You to RedDevil For This Useful Post:

|

|

04-01-2019, 06:47 PM

04-01-2019, 06:47 PM

|

#1029 (permalink)

|

|

Rat Racer

Join Date: May 2011

Location: Route 16

Posts: 4,150

Thanks: 1,784

Thanked 1,922 Times in 1,246 Posts

|

Quote:

Originally Posted by redpoint5

I was getting a lot back in rewards and paid off the balance every month, so incurred no interest. To this day, I have never paid any interest on a credit card.

|

+1

Credit is a tool. If you're going to live beyond your means, it'll help you do that and make sure you keep doing it. If you're going to live within your means, it'll help you do that, too.

__________________

Quote:

Originally Posted by sheepdog44

Transmission type Efficiency

Manual neutral engine off.100% @∞MPG <----- Fun Fact.

Manual 1:1 gear ratio .......98%

CVT belt ............................88%

Automatic .........................86%

|

|

|

|

|

|

The Following 3 Users Say Thank You to Fat Charlie For This Useful Post:

|

|

04-03-2019, 12:30 AM

04-03-2019, 12:30 AM

|

#1030 (permalink)

|

|

AKA - Jason

Join Date: May 2009

Location: PDX

Posts: 3,618

Thanks: 328

Thanked 2,166 Times in 1,464 Posts

|

Quote:

Originally Posted by roflwaffle

I'd like for the world to switch from ICEs to EVs overall. Profits are great, but they aren't everything. Amazon's done fairly well with little profit.

|

Amazon made $10.1 Billion in 2018.

Quote:

Originally Posted by Xist

II asked what she thought of Dave Ramsey...

|

Dave Ramsey has some good basic advice for someone looking to dig out of debt. It is a very basic and low risk way to live. However, He isn't the prophet that some make him out to be.

My wife and I used his "Baby Steps" to get out of debt. We started at 25 and it was a very tight 7 years. (I also but my wife through 5 years of school in that time without taking on any new debt). However, the two biggest keys are 1. Making the goal to get your finances in order. 2. Creating a budget so you know where your money is going. Set a goal, make a plan, work the plan.

We never made it to debt free stage because it makes absolutely no sense to pay off our 3.25% mortgage when we have been making many times more than that investing in the index funds. So I still have a mortgage but I also have many multiplies of that mortgage balance in investments accounts. We will pay it off before we retire in a few years but that is simply for peace of mind.

Ramsey and Kiyosaki (Rich Dad, Poor Day) are the two poles. One says almost all debt is bad and the other that you should always be leveraged and using other people's money. The best result is likely somewhere in the middle.

Last edited by JSH; 04-03-2019 at 12:57 AM..

|

|

|

|

|

The Following User Says Thank You to JSH For This Useful Post:

|

|

|